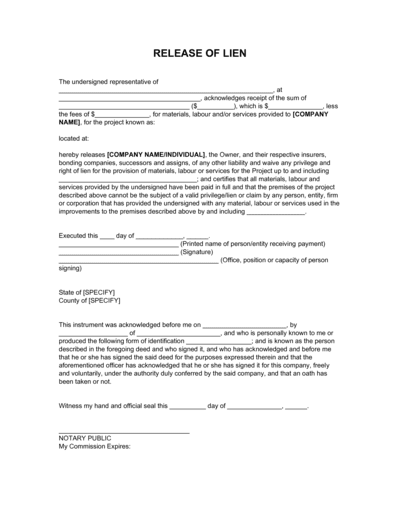

Release Of Lien Template

Securing Ownership with a Release of Lien

A Release of Lien is a vital document for clearing ownership rights on a property or asset after a debt is paid. This document formalizes the lender's acknowledgment that the borrower's obligation has been satisfied, removing the legal claim on the asset and transferring clear ownership to the borrower.

The Release of Lien serves as a regulatory framework that specifies the terms of lien removal, ensuring transparency and protecting the interests of all parties involved. By recording the satisfaction of the debt, the document clears the lien from public records and safeguards the asset's title.

What is a Release of Lien?

A Release of Lien is a legally binding document that acknowledges the satisfaction of a debt secured by a lien on a property or asset. It removes the lienholder's claim, confirming that the debtor has fulfilled their financial obligations, and effectively clears the asset's title.

Key Elements of a Release of Lien

A comprehensive Release of Lien document should effectively address:

- Identifying Information - Provides details about the lienholder, borrower, and asset involved to ensure accurate identification.

- Lien Details - Summarizes the original lien, including the date of filing, reference number, and nature of the debt secured.

- Acknowledgment of Satisfaction - Confirms that the debt obligation has been satisfied, thereby releasing the lienholder's legal claim on the asset.

- Authorized Signature - Requires the authorized signature of the lienholder, often notarized, to formalize the release of the lien.

- Recording Information - Outlines instructions for recording the release in public records, clearing the asset's title and making the release official.

Supporting Documents for Implementing a Release of Lien

To enhance the effectiveness of a Release of Lien, related documents can be incorporated:

- Affidavit - A sworn statement made under oath that attests to specific facts, which can include confirming the settlement of a debt. It provides an official record of the circumstances being verified.

- Promissory Note - A written promise by a borrower to repay a specified sum of money to a lender under agreed terms, detailing the amount, repayment schedule, interest rate, and other conditions of the loan.

- Receipt - A receipt showing payment is crucial for proving that the debt tied to a lien has been satisfied.

Why Employ a Detailed Template for a Release of Lien?

Utilizing a detailed template for drafting your Release of Lien document offers significant benefits:

- Legal Protection - Ensures that the lienholder's claim is officially removed, protecting the borrower from future disputes.

- Clarity in Ownership - Confirms the removal of the lien, providing the borrower with a clear title to the asset.

- Efficiency in Documentation - Streamlines the process of recording the release, ensuring timely updates to public records.

- Risk Mitigation - Minimizes the risk of disputes or legal issues by clearly outlining the satisfaction of the debt.

A well-structured Release of Lien document is crucial for formalizing the satisfaction of debt obligations and securing clear ownership rights. This essential document not only removes the lienholder's claim but also helps in safeguarding the borrower's interests.

Updated in May 2024